Baking Big Without Burning Out: What Industrial Ovens Get Right

Scaling a bakery isn’t just about bigger batches; it’s about smarter tools. You can have the best ingredients and the right people, but if your equipment slows you down, forget consistency. That’s why manufacturers pay close attention to performance. The key is to get the right items from the best tunnel oven manufacturers.

But there’s another layer to this. Consistency isn’t just a luxury anymore; it’s a necessity. Today’s consumers expect exactness. One off-brand bake, and they’re jumping ship. That’s why food producers are taking a hard look at their equipment and asking, “Is this really keeping up?”

Batch Ovens Just Don’t Cut It Anymore

Remember when baking trays meant small wins and long nights? Those days are numbered. Businesses feeding hundreds or thousands don’t have time to babysit the oven door. Batch baking creates bottlenecks, forces labor costs up, and messes with consistency. Tunnel ovens, by contrast, don’t slow down for anything. The process is continuous, clean, and predictable. Once your dough hits the belt, you’re already thinking about the next batch.

Uniform Results Matter More Than You Think

There’s nothing worse than a perfect top and an undercooked base. Or one tray golden brown while another looks like it went through a tanning bed on high. These aren’t just minor flaws; they cost money and trust. High-volume gear isn’t just about speed. It’s about delivering the same result, tray after tray, hour after hour. Tunnel ovens use calibrated heat zones and controlled airflow. No second-guessing, no rotating trays mid-bake.

The Setup Doesn’t Take a Degree in Engineering

Let’s not pretend every bakery has a technician standing by. If your equipment isn’t intuitive, you’re wasting time. A good oven interface tells you what you need to know, nothing more. Heat, timing, belt speed. Done. Some operators joke it’s easier than programming the office microwave. But that simplicity? That’s by design.

Space Isn’t Cheap, So Gear Should Fit the Flow

You don’t need a massive warehouse to use tunnel ovens. Today’s models come in different sizes and layouts, ideal for kitchens where every square meter counts. Modular setups allow you to grow production without knocking down walls. That kind of adaptability isn’t flashy, but it keeps you in business.

Cleanliness Isn’t Just for Compliance

Scrubbing down greasy corners at 2 AM? Nobody wants that. And inspectors definitely don’t tolerate it. Top-tier equipment now includes features that simplify cleaning, removable parts, easy-access panels, and fewer places for buildup to hide. Less time cleaning means more time baking. And more time sleeping, too.

Maintenance Shouldn’t Break the Schedule

Downtime is a budget killer. Smart operations pick ovens that don’t demand constant attention. Preventive maintenance should feel like a pit stop, not a rebuild. Simple diagnostics and fast-access service areas help keep things moving without calling in an army of specialists.

Good food starts with good tools. And in commercial baking, there’s little room for error or slowdowns. The industry is moving fast, and operations that want to keep up are rethinking what goes into their kitchens. Tunnel ovens aren’t just a trend. They’re part of the shift to smarter, steadier, and more efficient baking.…

When buying a portable air conditioner, budget and cost considerations are important factors that need to be considered. The price range of these units varies depending on their size, cooling capacity, and energy efficiency ratings. It’s essential to determine your budget before making any purchase decisions. One crucial aspect of considering the cost is understanding the long-term expenses of operating a portable air conditioner. While purchasing an affordable unit may seem like a good idea initially, higher energy consumption could lead to more significant monthly electricity bills in the future. Remember that additional costs, such as installation fees or maintenance requirements, will affect overall expense estimates beyond just upfront costs.

When buying a portable air conditioner, budget and cost considerations are important factors that need to be considered. The price range of these units varies depending on their size, cooling capacity, and energy efficiency ratings. It’s essential to determine your budget before making any purchase decisions. One crucial aspect of considering the cost is understanding the long-term expenses of operating a portable air conditioner. While purchasing an affordable unit may seem like a good idea initially, higher energy consumption could lead to more significant monthly electricity bills in the future. Remember that additional costs, such as installation fees or maintenance requirements, will affect overall expense estimates beyond just upfront costs.

There are a few things to keep in mind when socializing: be present, be yourself, and be interested. It’s also important to remember that not everyone will want to be your friend – and that’s okay.

There are a few things to keep in mind when socializing: be present, be yourself, and be interested. It’s also important to remember that not everyone will want to be your friend – and that’s okay.

The first thing that you need to consider is the materials you will cut using the plasma cutters. Cutting different materials requires a different set of features on the plasma unit.

The first thing that you need to consider is the materials you will cut using the plasma cutters. Cutting different materials requires a different set of features on the plasma unit. Many companies offer different features for their plasma cutters. You need to know what you want from a plasma cutter. Then, see if there are any features of a plasma cutter that suit your need. If you are unsure what features to look for, find plasma cutters with Air Purging or Venting System.

Many companies offer different features for their plasma cutters. You need to know what you want from a plasma cutter. Then, see if there are any features of a plasma cutter that suit your need. If you are unsure what features to look for, find plasma cutters with Air Purging or Venting System.

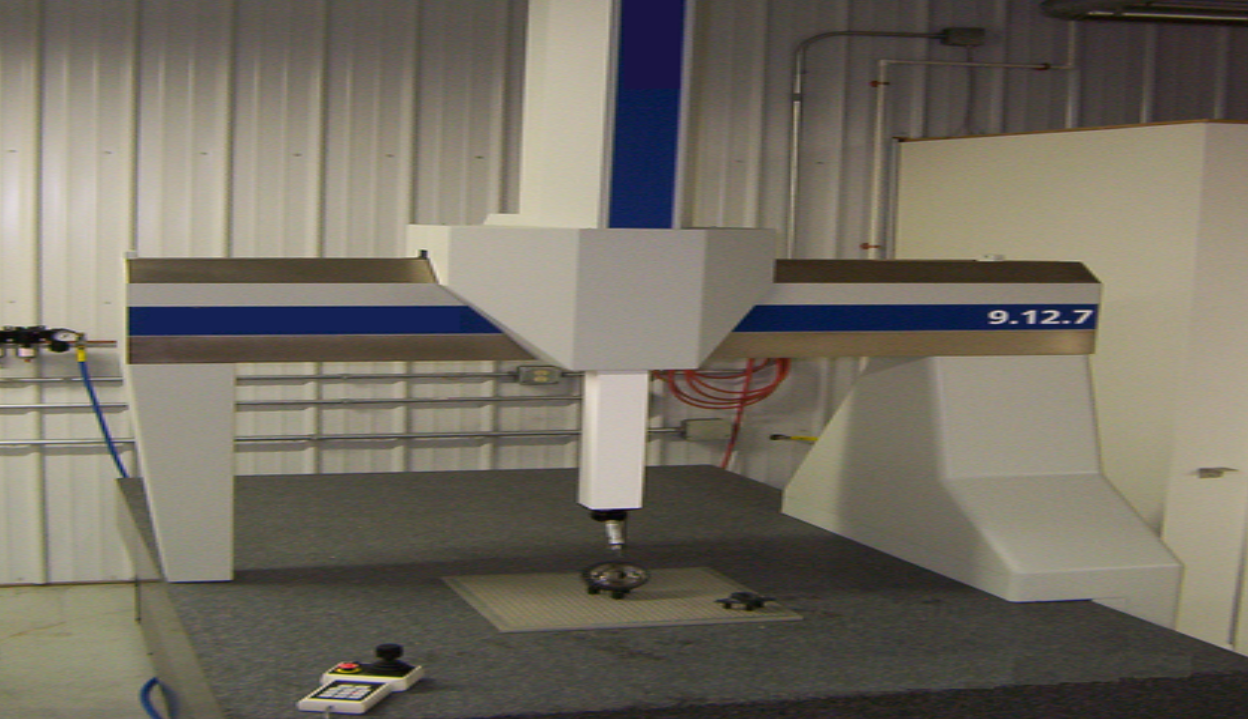

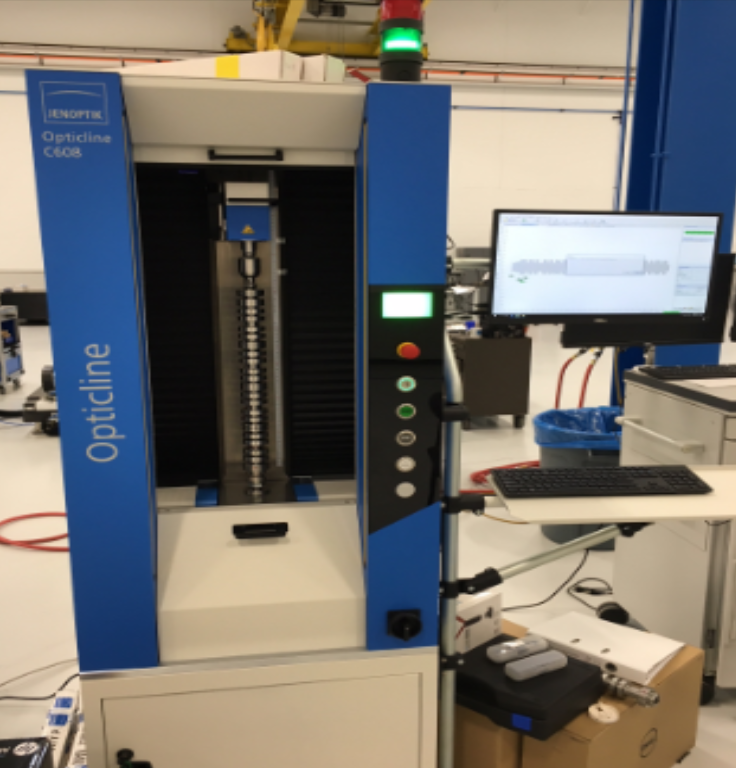

The CMM technology saves the users both time and money. As manufacturing gets more refined and complex, you are required to produce precise and accurate measurements. The use of CMM inspection services will provide favorable results for your company. You are at liberty to pick Gantry, Portable or Bridge CMM.

The CMM technology saves the users both time and money. As manufacturing gets more refined and complex, you are required to produce precise and accurate measurements. The use of CMM inspection services will provide favorable results for your company. You are at liberty to pick Gantry, Portable or Bridge CMM.